Let’s be honest: most budgeting advice feels like a punishment. “Cut your lattes.” “Live with roommates until 40.” “Never buy anything fun ever again.”

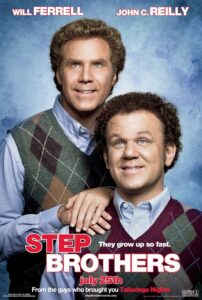

On the other hand, living with their parents worked out ok for these two. They went on to have wildly successfull NASCAR careers. Shake n bake.

Hard pass. If we wanted to feel that deprived, we’d just scroll Zillow listings in our zip code.

But here’s the good news: you don’t have to feel broke to spend less. In fact, you can build a life that costs way less—and actually enjoy it more.

This is about ditching the “sad salad” energy of budgeting and upgrading your money mindset instead. Because once you understand what you’re actually chasing (spoiler: it’s not a new sofa), everything changes.

Why We Spend More Than We Mean To

It’s not because we’re dumb. Or lazy. Or even that obsessed with throw pillows. It’s because we’re human—and humans are surprisingly bad at noticing tiny upgrades over time.

This phenomenon is called lifestyle creep, and it hits hard once you start earning more. You move to a nicer apartment… then suddenly need new rugs, new plants, a desk that’s not also a dinner table. Before you know it, you’re paying $1,500/mo to feel mildly annoyed at your lighting.

So how do you fight back without turning into a budget monk? You get smart. And a little sneaky.

1. Create Rich-Person Habits on a Frugal Budget

There’s a myth that rich people buy better stuff. Actually? They buy fewer things—but make sure each one improves their life.

Want to feel like a boss while staying under budget? Do this:

- Buy duplicates of your daily-use items—one at home, one in your bag, one at work. No more panic when you forget deodorant or phone chargers.

- Invest in a water filter and a big, beautiful bottle. You’ll stop buying drinks on the go and feel fancy AF while sipping.

- Use “predictable luxuries” like fancy candles or premium coffee beans you make at home. They feel expensive but cost far less over time than restaurant or retail hits.

These upgrades hit the experience craving your brain wants, without nuking your checking account.

2. Identify Your “Spend Triggers” and Outwit Them

Your brain’s not trying to sabotage you—it’s just trying to help you feel better. The problem? Its idea of “better” is often “let’s order four things from Amazon and hope one brings us joy.”

Common triggers include:

- Feeling behind or bored (scrolling leads to cart-filling)

- Envy (seeing your friend’s upgraded kitchen or weekend trip)

- Stress (“I deserve this” spending after a long day)

The solution isn’t willpower. It’s adding friction back into your spending.

Examples:

- Delete shopping apps and log in only on desktop

- Use a 24-hour hold rule—add it to a note, not your cart

- Put your cards in a literal drawer (out of sight = out of swipe)

These little interruptions force your brain to pause, reflect, and often say, “Wait, I don’t even like that thing.”

3. Automate the Right Kind of Growth

Most people automate spending. Subscriptions, swipe-to-pay, one-click ordering. But what if you automated good decisions instead?

Set up a free Chime account (they’ll literally pay you $100 to sign up), and use:

- Round-ups to save small amounts passively

- Split direct deposits—money lands in savings before you even see it

- Goal-based buckets that feel like real progress, not deprivation

It’s the closest thing to financial autopilot that doesn’t involve a trust fund.

4. Embrace the “Half Upgrade” Rule

When you’re tempted to do a full lifestyle glow-up, try this:

Only upgrade half the equation.

Example: You want a better bedroom. Instead of buying all new furniture, just swap the pillows and get blackout curtains. (Boom—luxury nap zone unlocked.)

Same for wardrobe: new shoes? Cool. Keep the rest. Want a better morning routine? Buy one amazing mug, not a whole kitchen’s worth of gadgets.

This approach scratches the upgrade itch without opening the floodgates.

5. Choose Experiences Over Aesthetics

Your brain actually remembers experiences more than purchases. So instead of chasing “the look,” go after “the feeling.”

Instead of:

- Spending $300 to “refresh your space,”

- Spending $300 on a weekend hiking trip with a friend, or a local class you’ve always wanted to take.

One lasts longer. And probably results in fewer throw pillows.

6. Know the Difference Between Frugal and Cheap

Frugal = strategic. Cheap = reactive.

Frugal people:

- Spend on tools that save time or health (like this high-capacity air fryer that eliminates the need for takeout 3x/week)

- Use budgeting tools that reward long-term thinking

- Say no often, but yes boldly when it counts

Cheap people cut indiscriminately. Don’t be cheap. Be clever.

7. Build a “Default Life” That Feels Good—Even on Slow Days

If your everyday life feels like a waiting room between weekends, you’re gonna keep spending to escape it. Instead, design your base life to feel enjoyable without needing upgrades:

- Routine rituals: a favorite playlist, your $1.19 coffee setup, morning sunlight time

- Spaces you enjoy: rearranged furniture, one good candle, one soft blanket

- Low-cost hobbies: walking, library books, writing, learning new skills

This doesn’t mean never splurging. It means not needing to splurge just to tolerate Tuesday.

8. When to Say Yes: Smart Splurges

You know that feeling when a purchase actually pays off? When it saves you time, reduces stress, or fixes a problem for good?

That’s a Smart Splurge. The kind of buy that keeps on giving.

Examples include:

- Noise-canceling headphones (peace in every room)

- A $40 massage gun instead of paying $80/session

- A standing desk converter instead of a $600 new desk

These purchases stretch your dollars and improve your quality of life. Big win.

Final Thoughts

You don’t need to become a minimalist monk or budget like it’s the Great Depression. You just need a few key shifts:

- Interrupt unconscious spending

- Design default joys

- Make smart splurges and sneaky swaps

A rich life isn’t about spending more. It’s about building something you actually like living in—without needing to constantly escape it.

And if you can do that while keeping more money in the bank? That’s not deprivation. That’s domination.

0 Comments